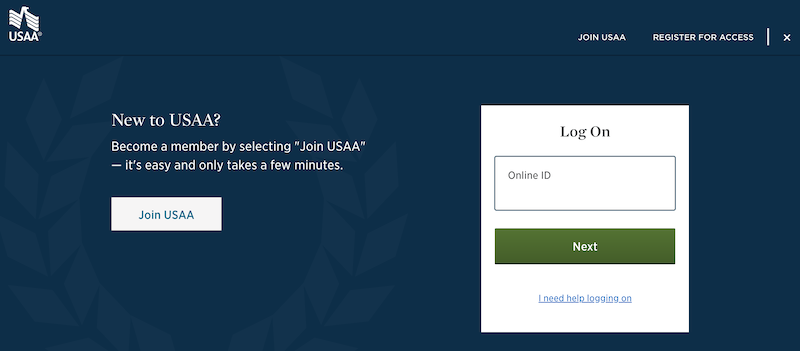

Looking for USAA Event Insurance? Confused as to why USAA forwards you to a third party? In short, USAA does not write their own policies, but instead will direct you to another insurer (Markel) only if you have a USAA login.

Fortunately, there are some great alternatives that can help you secure an event insurance policy fully online in minutes.

See our comprehensive 2025 review of all the major U.S. event insurance companies:

Top Alternatives to USAA Event Insurance:

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Damage to rented premise limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Damage to rented premise limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required

Policies like USAA Event Insurance (also referred to as Special Event Insurance) are purchased to protect event hosts from financial and legal burdens that could arise from injuries or property damages that occur during the event. Most venues now require it as well as part of the rental agreement for all types of events, including wedding, baby showers, and birthday parties.

From a cost standpoint, policies can start at $75, however it is important to ensure the policy limits meet the requirements for the event and/or venue.

The below video provides a good example as to why purchasing coverage is important: