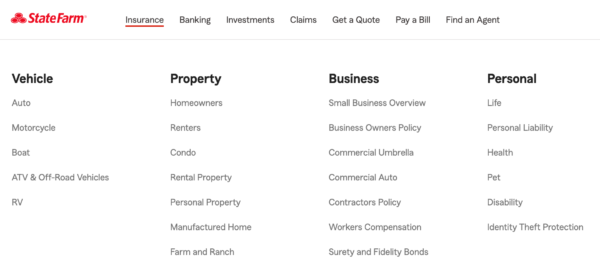

Looking for State Farm Event Insurance? It appears that State Farm does not offer event insurance.

Fortunately, there are other options available.

See our comprehensive 2025 review of all the major U.S. event insurance companies:

Top Alternatives to State Farm Event Insurance:

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Min. damage to rented premise limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Min. damage to rented premise limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required

Policies like State Farm Event Insurance (also referred to as Special Event Insurance) protect event hosts from financial and legal burdens that could arise from injuries or property damages that occur during the event. Most venues now require it as well as part of the rental agreement for various types of events, including wedding, baby showers, and birthday parties.

From a cost standpoint, policies can start at $75, however it is important to ensure the policy limits meet the requirements for the event and/or venue.

The below video provides a good example as to why purchasing coverage is important:

Still not convinced? Consider these examples where event insurance came to the rescue:

- Photographer’s camera bag with event pictures was stolen during the event. Hotel accused of failing to provide adequate security. Event Insurance paid $3,000 plus defense costs (legal fees).

- Venue held Rentee responsible for damaged carpet at reception. Event insurance paid $5,523.81.

- Wedding guest slips on rose flower. Event insurance paid $4,200.00.

- Groom while carrying his bride dropped her. Law suit against venue. Event insurance paid $12,250.00.

- A guest was injured in a fall on a slippery dance floor. Law suit alleged hotel provided improper dance floor. Event coverage paid – $2,500 plus legal fees (defense).

Because costs can escalate quickly, it is always recommended to get event insurance, regardless of the size of the event.

Common Types of Event Insurance

When you plan your event, you need different insurance policies. Here are the main ones:

- General Liability Insurance: Gives help if someone is hurt or property is damaged.

- Liquor Liability Insurance: If you serve drinks, this policy stands for alcohol-related claims.

- Event Cancellation Insurance: Returns costs if unexpected events force you to cancel.

- Property Insurance: Guards event tools, decor, and rented items from harm or theft.

- Workers’ Compensation Insurance: Covers staff or contractors if they get hurt at work.

Determining Your Event Insurance Requirements

Many things guide the needed insurance for your event:

- Event Type: A music show needs different coverage from a wedding or meeting.

- Venue Policy: Check the venue rules. They may set limits or ask to add them as insured.

- Risk Level: Events with high risk, like those with physical fun or drinks, need more coverage.

- Local Laws and Permits: Some areas require insurance permits before a public event.

It is a good idea to talk with an insurance expert who works with events. They help you find exactly what you need.

How to Obtain Event Insurance

You get event insurance by working with a provider or broker who knows event policies. Here is one way to work through the steps:

- Think about the risks of your event.

- Prepare details like the date, place, number of guests, and planned activities.

- Get quotes from more than one provider.

- Read what each policy covers, the limits, and what it does not cover.

- Buy the policy that best fits your event needs.

- Give copies of the insurance to the venue and local authorities if needed.

Tips to Ensure Adequate Coverage

- Check that your policy limits are enough for all possible claims.

- Ask the venue to be named as insured if they request it.

- Look at the list of exclusions. Some risks may not be covered.

- Have vendors and helpers show that they have their own insurance.

- Update your policy if your event plans change.

Event Insurance Requirements Checklist

Use this guide to check that your event has proper insurance:

- Check the venue rules on insurance.

- See if drinks are served; if so, include liquor liability insurance.

- Think about event risks and needed coverage.

- Get general liability insurance with enough limits.

- Think of cancellation insurance for things you cannot control.

- Make sure property and equipment are covered.

- Confirm that vendors and helpers show proof of insurance.

- Add the venue or other parties to your policy if required.

- Protect staff with workers’ compensation if needed.

- Keep insurance certificates close by during the event.

Frequently Asked Questions About Event Insurance Requirements

Q1: What does a small private event need for insurance?

A1: Small private events have fewer demands. It is best to get general liability insurance, especially if you rent a space. Check the venue rules for a clear answer.

Q2: Does serving alcohol change insurance needs?

A2: Yes. Serving alcohol often brings a need for liquor liability insurance to cover issues from alcohol.

Q3: Can I get insurance at the last minute?

A3: You might find last-minute options. It is best to secure your coverage early. This way you meet venue or permit dates without stress.