Considering One Day Event insurance for your event insurance needs? The below One Day Event review was part of a broader analysis of over a dozen insurers.

Overall our One Day Event insurance review gave One Day Event a 3.5 out of 5 based on our analysis criteria found here.

What We Like About One Day Event Insurance

- Clean user experience and design

- No deductible

- Automatic $5M GL aggregate and $1M damage to rented premises limits

- Auto liability option (however, see below)

What We Didn’t Like About One Day Event Insurance

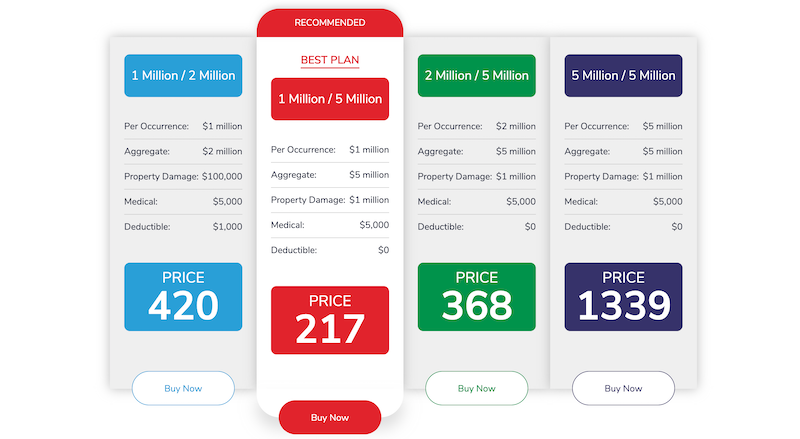

- Can’t see the price until the very end

- No sample policy or endorsements to review

- Appears to offer hired/non-owned auto, however “Non-Owned/Hired Auto is subject to approval and will affect your quote & premium.”

- Unclear if the price quote includes auto liability or if there’s an additional charge after approval

- Sneaky pricing layout (we’re not sure what the purpose of showing the $1M/$2M option is when it’s 2x the price)

Lowest Cost Available

Admittedly, this was tough to determine based on the site design so we did our best:

$138

- $1M/$5M (occurrence/aggregate) GL

- $1M damage to rented premises

- Host liquor included

- $5,000 medical expense limit

- Waiver of Subrogation endorsement: Not included

- Primary Noncontributory endorsement: Not included

Alternative Options to One Day Event

See here for a summary of our analysis of a dozen insurers.

Our Top Picks For Liability Coverage

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Starts at $75 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Starts at $160 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required