Considering EventHelper Insurance for your event insurance needs? The below EventHelper review was part of a broader analysis of over a dozen insurers.

Overall our EventHelper Review gave EventHelper a 4 out of 5 based on our analysis criteria found here. Note that EventHelper’s coverage model is to put all policy holders into a risk purchasing group/membership.

What We Liked About EventHelper

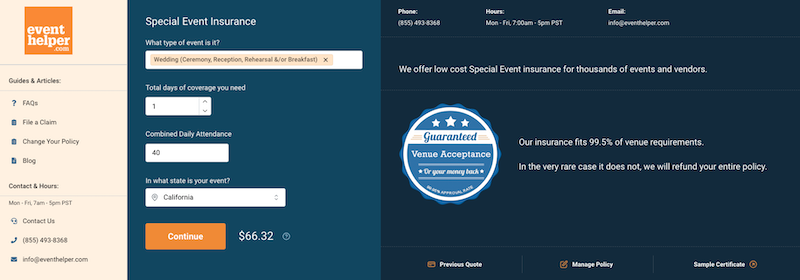

- Quotes update in real time so you don’t have to wait until the end to see the price

- Better than average pricing (starts at $66 for $1M/$2M GL coverage for up to 40 people)

- Great for small groups under 72 people (see below)

- Ability to edit policies online after purchase

- Good user experience on desktop and mobile

- Host liquor included

What We Didn’t Like About EventHelper

- Need to pay for another full day of coverage if the event goes past midnight

- $22.14 fee if the policy needs to be cancelled

- Not clear who the insurance company is

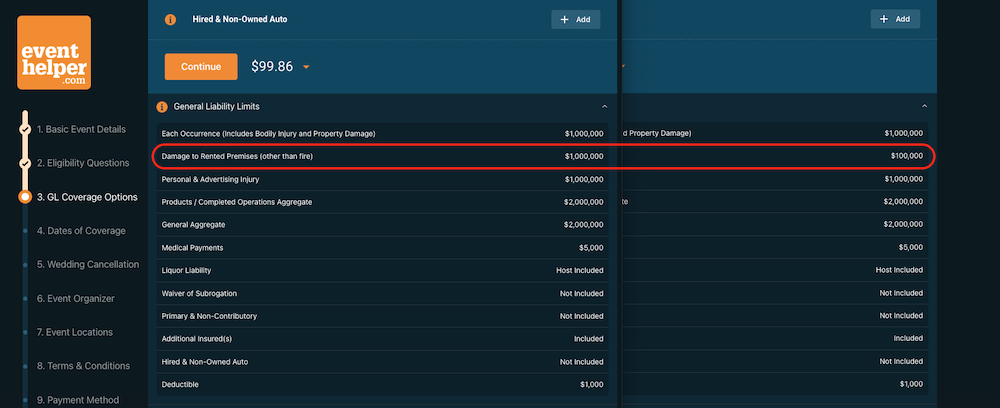

- $1,000 deductible that can only be removed for an additional fee (some states you can’t remove it at all)

- Damage to rented premises of only $100,000 (with no option to increase from what we could tell), but for some reason it’s $1M if the attendance size is less than 72 people

- If you opt-in for the Waiver of Subrogation and Primary Noncontributory endorsements (adds $70+), it appears to bring the damage to rented premises back up to $1M

Lowest Cost Available

$66

- $1M/$2M (occurrence/aggregate) GL

- $1M damage to rented premises (drops to $100,000 if the attendance size is over 71)

- Host liquor included

- $5,000 medical expense limit

- Waiver of Subrogation endorsement: Not included

- Primary Noncontributory endorsement: Not included

Alternative Options to EventHelper

See here for a summary of our analysis of a dozen insurers.

Our Top Picks For Liability Coverage

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Starts at $75 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Starts at $160 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required