Considering EventGuard for your event insurance needs? The below EventGuard review was part of a broader analysis of over a dozen insurers.

Note: EventGuard is a reseller/broker for Markel Event Insurance. It is cheaper to purchase directly from Markel.

Overall our EventGuard Review gave EventGuard a 2 out of 5 based on our analysis criteria found here.

See our comprehensive 2025 review of all of the major U.S. event insurance companies:

What We Like About EventGuard

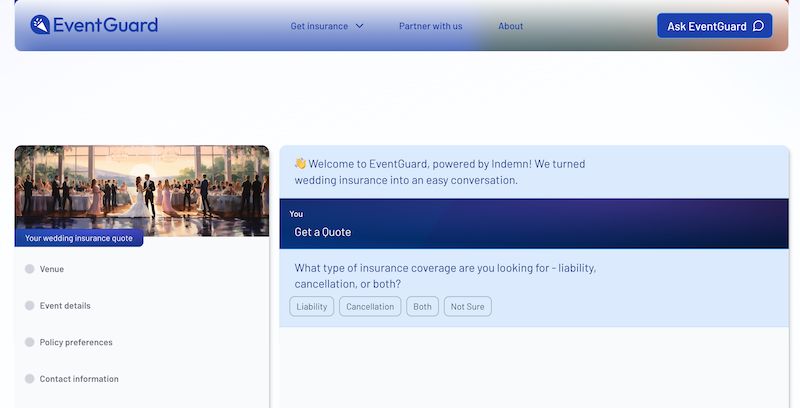

- Cool design

- Very hip with the chatbot/AI interface

- Can get an initial quote in 3 questions

What We Didn’t Like About EventGuard

- Expensive (see below)!

- For an “A.I.” platform, it’s not very intuitive. For example:

- A lot of waiting for the A.I. to think/respond

- When it asks you for the venue address, you can put in anything (there doesn’t seem to be any validation). Same with phone number.

- If you make a mistake, it’s hard to go back and fix things.

- Tough to get through the whole application (after the initial quote).

- i.e. In a normal web interface there are visual cues that can help a user along the way. With EventGuard you have to think about and ask it questions if you get stuck.

- They claim “We searched the market and found the Markel wedding insurance program to be the best.” However, they also clearly state that they offer Markel’s policy so we question how much “searching” is actually being done.

- It’s unclear what’s included in the initial quote or if that’s the final price.

- i.e. It doesn’t ask the number of attendees, which is a big factor in the final price

- $1,000 deductible

Lowest Cost Available

$175

- $1M/$1M (occurrence/aggregate) GL limits

- $1M damage to rented premises limit

- Host liquor included

- No medical expense coverage (from what we could see)

- Waiver of Subrogation endorsement: Not included (from what we could see)

- Primary Noncontributory endorsement: Not included (from what we could see)

- $1,000 deductible

EventGuard Review Summary

The insurance is underwritten by Markel so it appears EventGuard is simply a reseller. This could explain the high price of the policy and it’s cheaper to go directly through Markel.

Other Options

See here for a summary of our analysis of a dozen insurers.

Our Top Picks For Liability Coverage:

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Starts at $75 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Starts at $160 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required