When it comes to event insurance for venues, which insurer is best? If you’re in the business of renting out your venue to third-party renters for things like weddings, birthday parties and baby showers, you probably already make event insurance mandatory for the renters (and if not, you should!).

But with all the options out there, which insurer is best for event insurance for venues? Well the answer is actually a combination of two insurers (depending on group/attendee size).

See our comprehensive 2025 review of all of the major U.S. event insurance companies:

Based on our review of all of the major U.S. event insurance companies, we recommend offering the following insurers to your renters.

If your venue does NOT require the Waiver of Subrogation and/or Primary Noncontributory endorsements:

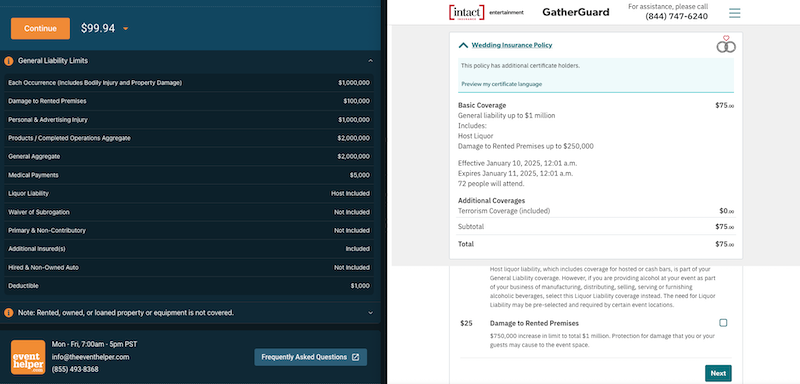

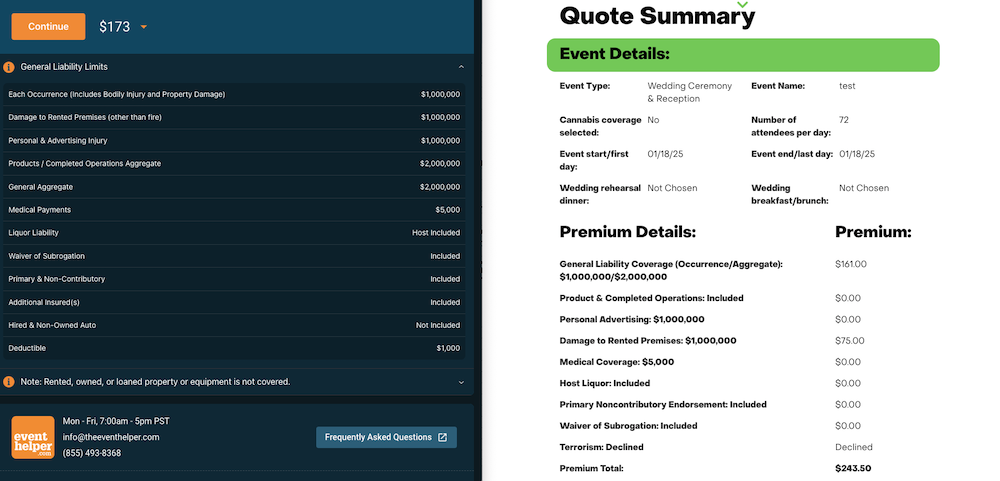

Event Helper for events with 71 attendees or less. After 71 people, the damage to rented premises limit drops from $1M to $100,000 (yikes!).

GatherGuard for events larger than 71 attendees where $250,000 damage to rented premises is always included and upgrading to $1M starts at only $25.

However, for the minor price difference and to not confuse your renters, it may be best to just offer GatherGuard.

If your venue does require the Waiver of Subrogation and/or Primary Noncontributory endorsements:

Event Helper if you are okay with a $1,000 deductible (can be removed for an extra fee in some states).

Special Insurance if you rather have a $0 deductible policy. Also, includes coverage for set up and rehearsal dinner (the day before) and/or brunch and teardown (the day after) for no additional cost.

When it comes to event insurance for venues, these are the best options for coverage and price. All three insurers can onboard your venue’s limits and additional insured requirements so it’s pre-populated for all future policies.

Not sure what your event insurance for venues requirements should be? Learn more here.