The below K&K event insurance review was part of a broader analysis of over a dozen insurers.

Overall our K&K event insurance review gave K&K a 1 out of 5 based on our analysis criteria found here.

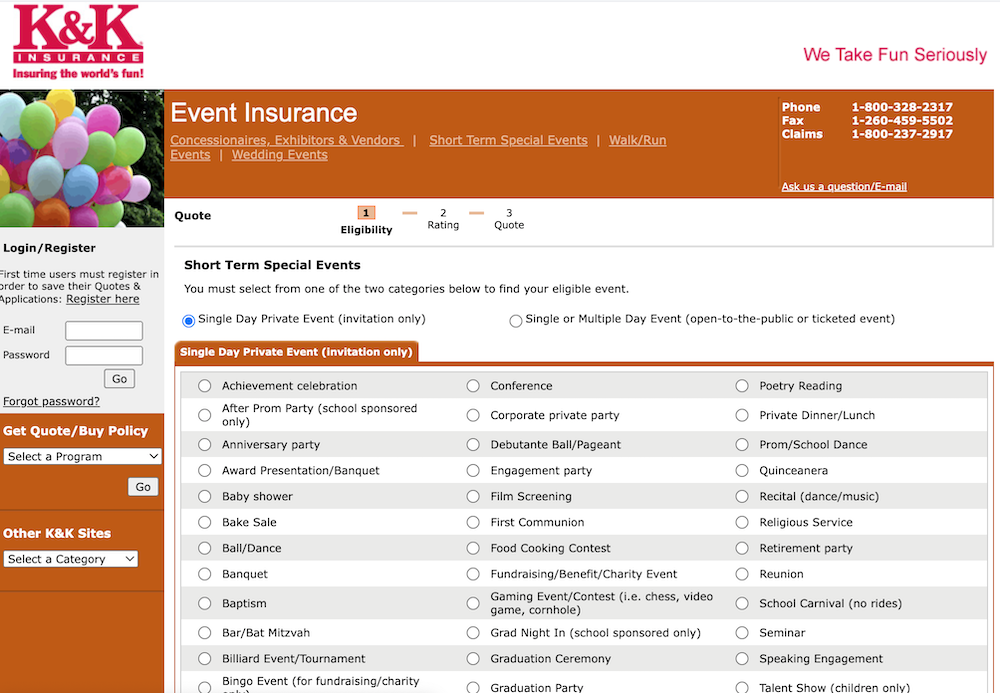

K&K / K and K Event Insurance is an event insurance liability product that is available through Aon that is usually secured for events like weddings, birthday parties, baby showers, and other one-day events.

What We Like About K&K Event Insurance

- Owned by Aon who has been around for 70+ years

What we didn’t like about K&K Event Insurance

- Outdated Website: K&K’s website is very outdated and not ideal for tablets or mobile phones

- No Sample Policy to Review: There’s no obvious sample policy that can be reviewed

- Restricted Liquor Liability Coverage: While K&K does offer liquor liability coverage, it’s not available in several states, including Alaska, DC, Hawaii, Iowa, and Michigan

- Membership Requirement: By applying for K&K’s insurance, you’re automatically applying for membership in their Sports, Leisure and Entertainment Risk Purchasing Group (RPG)

- There’s probably more, but we gave up because the website design is so bad

Lowest Cost Available

$179

- $1M/2M (occurrence/aggregate) GL

- $1M damage to rented premises

- Host liquor included

- $5,000 medical expense coverage

- Waiver of Subrogation endorsement: Included

- Primary Noncontributory endorsement: Not included

Alternative Insurers:

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Damage to rented premises limit: $250,000 or more

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Damage to rented premises limit: $300,000 or more

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required