Considering Insurance Canopy Event Insurance for your event insurance needs? The below Insurance Canopy Event Insurance review was part of a broader analysis of over a dozen insurers.

Overall our Insurance Canopy Event Insurance review gave Insurance Canopy a 2.5 out of 5 stars based on our analysis criteria found here.

What We Like About Insurance Canopy Event Insurance

- Good starting price

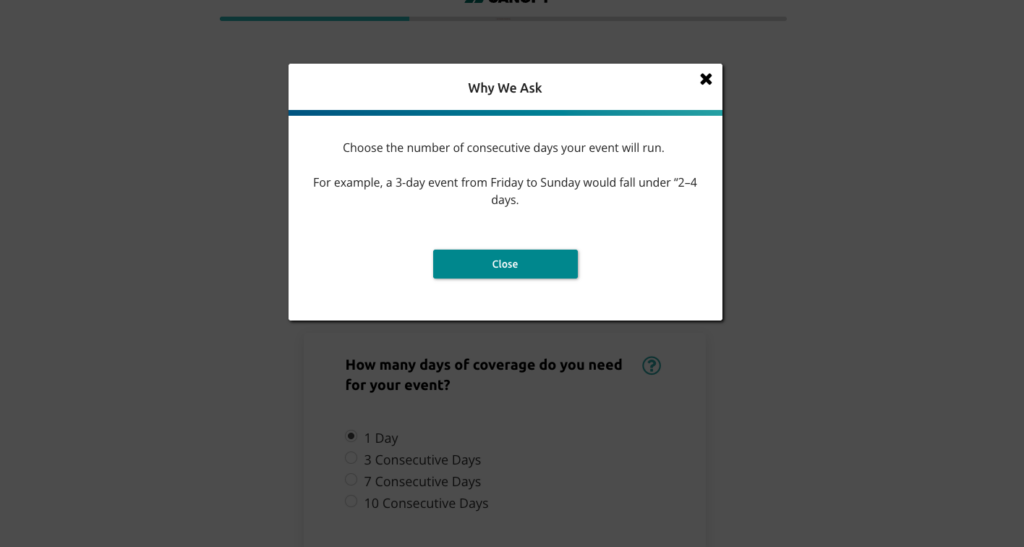

- Simple user experience and design

- Host liquor included

- No deductibles

- Option to get $1M of Hired & Non-Owned Auto Coverage

What We Didn’t Like About Insurance Canopy Event Insurance

- Need to go through the entire application process to see any pricing

- Damage to rented premises limit starts at $100,000 (a minimum of $250,000 is recommended)

- No options to add Primary Noncontributory or Waiver of Subrogation endorsements

- Inconsistent messaging:

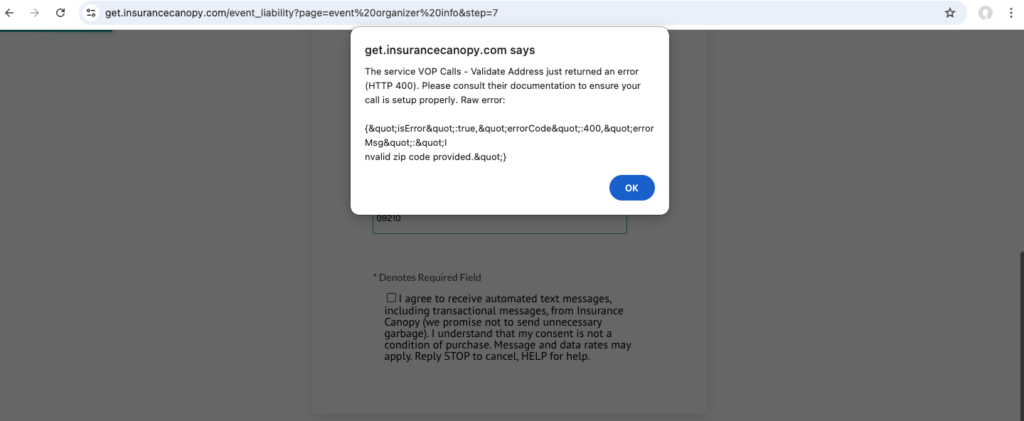

- Buggy

Lowest Cost Available for Insurance Canopy

$90

- $1M/$2M (occurrence/aggregate) GL

- $100,000 damage to rented premises

- Host liquor coverage: Included

- $5,000 medical expense limit

- Waiver of Subrogation endorsement: Not included

- Primary Noncontributory endorsement: Not included

Alternative Options to Insurance Canopy

See here for a summary of our analysis of a dozen insurers.

Our Top Picks For Liability Coverage

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Starts at $75 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Starts at $160 for $1M/$2M GL coverage

Min. Damage to rented premises limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required