We analyzed over a dozen event liability insurance carriers/distributors in the U.S. (see full list below) for event liability insurance costs, user experience/design, policy endorsements and more.

We thought that the established insurers like Wedsure, eWed, and Wedsafe would come out on top, however we were pleasantly surprised with two new notable standouts below (keep scrolling for the full analysis).

Best Overall

GatherGuard

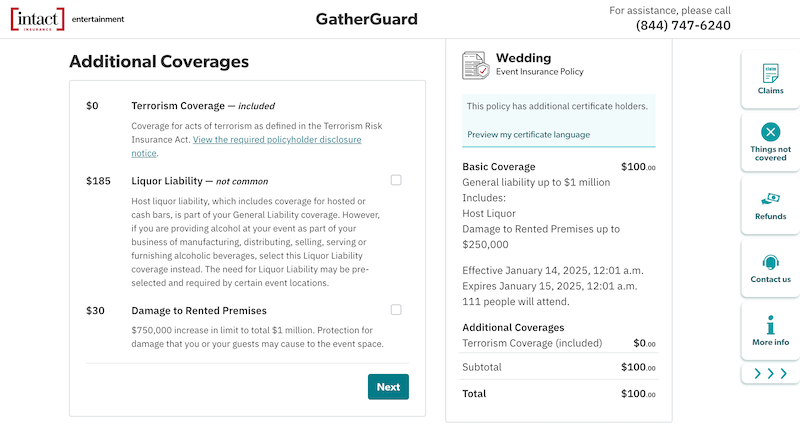

From pricing to coverage to design, GatherGuard by Intact really stood out. Great pricing, very accommodating for repeating events and the best option we could find if the Waiver of Subrogation and/or Primary Noncontributory endorsements are NOT required.

- $1M/$2M (occurrence/aggregate) policies starting at $75

- Minimum DRP included: $250,000

- No deductibles

- Host liquor liability always included

- Cancel up until the day before the event date for a full refund

- Sold directly by the insurer (no intermediaries)

SpecialInsurance.com

Special Insurance by GBLI is a hidden gem! Ideal for events requiring the Waiver of Subrogation and/or Primary Noncontributory endorsements. The pricing is very good considering that the two endorsements are included.

- $1M/$2M (occurrence/aggregate) policies starting at $160

- Minimum DRP included: $300,000

- No deductibles

- Host liquor liability included

- Cancel up until the day before the event date for a full refund

- Sold directly by the insurer (no intermediaries)

- Update June 23, 2025: All Special Insurance policies now include an Authenticator QR code allowing venues to quickly check the legitimacy of a policy certificate (and we have increased the score from 4.5 to 4.75 out of 5 accordingly)

Legend/Notes

- General liability limits when shown as $XM/$YM are the occurrence/aggregate limits

- DRP = Damage to rented premises

- Both desktop and mobile user experience was taken into consideration

- Based on common event types like weddings, birthday parties, social gatherings, etc.

List of Insurers Analyzed

Click on each to see more details:

BriteCo – 2 out of 5 stars

Cover My Events – 1 out of 5 stars

Ewed – 2.5 out of 5 stars

EventGuard – 2 out of 5 stars

Eventsured – 3 out of 5 stars

FLDean – 2 out of 5 stars

GatherGuard – 4.75 out of 5 stars

K&K – 1 out of 5 stars

Markel (also provider for Allstate and Geico) – 2 out of 5 stars

Nuptial Risk – 3 out of 5 stars (cheaper to go direct through Event Helper)

One Day Event – 3.5 out of 5 stars

SpecialInsurance.com – 4.75 out of 5 stars

State Farm – N/A

Thimble – 4 out of 5 stars

Travelers – 1 out of 5 stars

Wedsafe – 1 out of 5 stars

Wedsure – 2 out of 5 stars

Best for Venue Partnerships

Various insurers offer free venue partnerships where venues can provide their limit and other insurance requirements to the insurer ahead of time to be pre-populated on each policy. This can save venue managers hours each week on follow ups and corrections. Venues also get a free insurance landing page dedicated to their venue.

GatherGuard

- If Waiver of Subrogation or Primary Noncontributory endorsements are not needed

SpecialInsurance.com

- If Waiver of Subrogation or Primary Noncontributory endorsements are needed

Highest Liability Limits

Wedsure

- $2M/$5M available online starting at approximately $300

- Minimum $1,000 deductible on DRP

GatherGuard

- $2M/$2M available online starting at approximately $200

- $5M/$5M can be enabled with pre-approval of the venue/event location

Both Wedsure and GatherGuard allow for higher coverages, but require some pre-approvals. Please call the insurers for further details.

Most Affordable Event Liability Insurance Costs

GatherGuard

Best options if the Waiver of Subrogation and/or Primary Noncontributory endorsements are NOT needed.

- $1M/$2M (occurrence/aggregate) policies starting at $75

- Minimum DRP included: $250,000

- No deductibles

- Host liquor liability always included

SpecialInsurance.com

Ideal for events requiring Waiver of Subrogation and/or Primary Noncontributory endorsements.

- $1M/$2M (occurrence/aggregate) policies starting at $160

- Minimum DRP included: $300,000

- No deductibles

- Host liquor liability always included

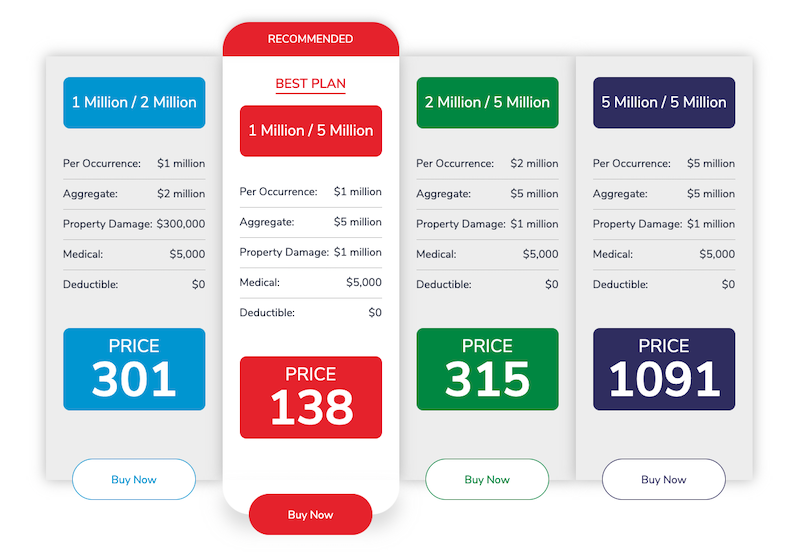

Highest Included DRP Limits

EventGuard

- DRP will match the aggregate GL limit. i.e. If the aggregate GL limit is $2M, then the DRP will be $2M

- Resells Markel (see below)

Markel

- DRP will match the aggregate GL limit. i.e. If the aggregate GL limit is $2M, then the DRP will be $2M

One Day Event

- $1M included in most plans

- We’re not a fan of the sneaky price listing that shows the $1M/$2M GL offering at almost 3x the price to make the $1M/$5M option seem like a great deal

- Note that GatherGuard provides $1M/$2M GL and $1M DRP for $100 (no medical included)

Best User Experience & Design

SpecialInsurance.com

- Very slick site

- Seems to require the least amount of steps and time to secure a policy

- Easy to use on mobile as well

- Pricing updates in real time so you don’t have to go all the way to the end just to see the price

Highest Medical Expense Limit

GatherGuard

- Provides the option for up to $15,000 in medical expense limit

Best Liquor Liability Option

GatherGuard

- Allows for upgrading from host liquor liability to liquor liability (learn about the differences here)

Most insurers automatically include host liquor liability, however if you are selling or distributing alcohol for a profit at your event, liquor liability is a must.

Non-Owned/Hired Auto Liability Providers

FLDean

- Up to $500,000 possible online

One Day Event

- Appears to offer it, however “Non-Owned/Hired Auto is subject to approval and will affect your quote & premium.”

- Unclear if the price quote includes auto liability or if there’s an additional charge after approval

Highest Number of Attendees Covered

GatherGuard

- Covers an event up to 5,000 people (wow!)

Best for Small Groups

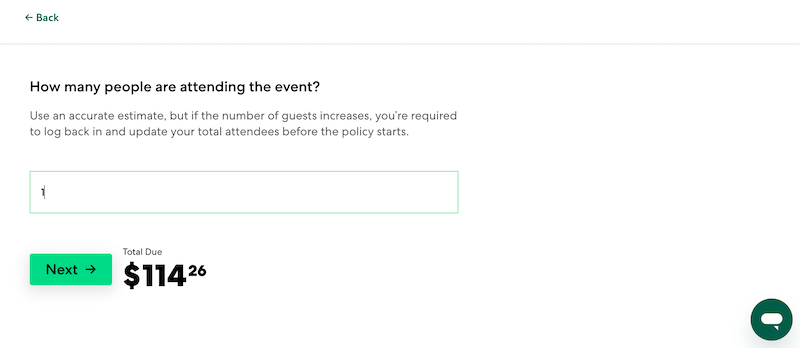

Thimble Event Insurance

- Price changes per each attendee starting at $114 with primary noncontributory and waiver of subrogation endorsements included

Best for Repeating Events

GatherGuard

- It appears you can get unlimited coverage days within a 90 day period for the same type of event (i.e. recurring weekly meetings, games, sports, etc.)

- Pricing seems to be based on total attendance over the course of all days

- i.e. A meeting each Monday for the next 3 weeks with 20 people attending each day is still $75 (or $25/day!)

- Pricing seems to be based on total attendance over the course of all days

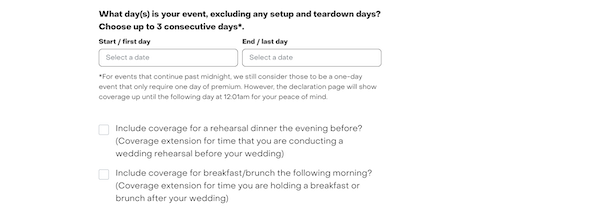

Best for Multi-Day Events

Example: You check in on Friday, the event/wedding is on Saturday, and you check out on Sunday and your venue requires coverage for the whole time you are on their property.

SpecialInsurance.com

- It appears that you can get coverage for “the day before” and “the day after” at no charge so long as you choose the rehearsal dinner and brunch options, which extends the coverage to 3 days

Analysis Criteria

Event Liability Insurance Costs

- Overall value to coverage

Included Coverages/Limits & Upgrade Options

- What coverages/limits are included in the base price

- What coverages/upgrades are available for an extra fee

User Experience & Design

Most of the time was spent here. Our thought is that nobody likes to have to get insurance (most people get it because they’re told to by the venue) so we focused on how easy each insurer made it for their users to find information and acquire coverage.

- General ease of use of the website on both desktop and mobile

- How easy was it to find basic information like:

- Sample policies

- Included endorsements, particularly primary noncontributory and waiver of subrogation endorsements

- Deductible information

- Refund/Cancellation policy

- Speed to obtaining the final/accurate price

- Choice/flexibility in coverages

- Ability to add additional insureds

FAQs

What is general liability insurance?

General liability coverage is a crucial component of event insurance that protects event organizers from financial losses due to third-party claims of bodily injury or property damage. This type of insurance typically covers:

- Bodily injury to event attendees

- Property damage to the venue or attendees’ belongings

- Medical expenses for injured parties

- Legal defense costs if sued

General liability insurance for events usually provides coverage limits ranging from $1,000,000 to $5,000,000. It safeguards against accidents such as slip-and-fall injuries or damage to rented premises. For example, if a platform collapses at your event and injures attendees, general liability insurance could cover their medical care and your legal defence if they sue .Some policies may also include additional coverages such as:

- Food and beverage product liability

- Non-owned auto coverage

- Employees/volunteers as additional insured

- Tenant’s legal liability

It’s important to note that general liability insurance does not cover intentional damages or accidents involving automobiles, aircraft, or watercraft.

What is damage to rented premises?

Damage to rented premises coverage, also known as Tenants Legal Liability, is a crucial component of event liability insurance. It provides protection for damages that may occur to a rented venue during your event. This coverage is typically included in special event insurance policies and offers financial protection if you’re found responsible for property damage to the rented space. Learn more here.

What are medical expense limits?

Refers to the maximum amount the policy will pay for reasonable medical costs resulting from bodily injuries caused by accidents during the event, regardless of fault. Learn more here.

What is liquor liability?

Event liquor liability insurance serves as a financial safety net for event organizers. It covers legal expenses, medical bills, and damages if an attendee causes an accident or injury while intoxicated. Learn the difference between host liquor liability and retail liquor liability here.

Use Pinterest? See our event insurance summary board here.