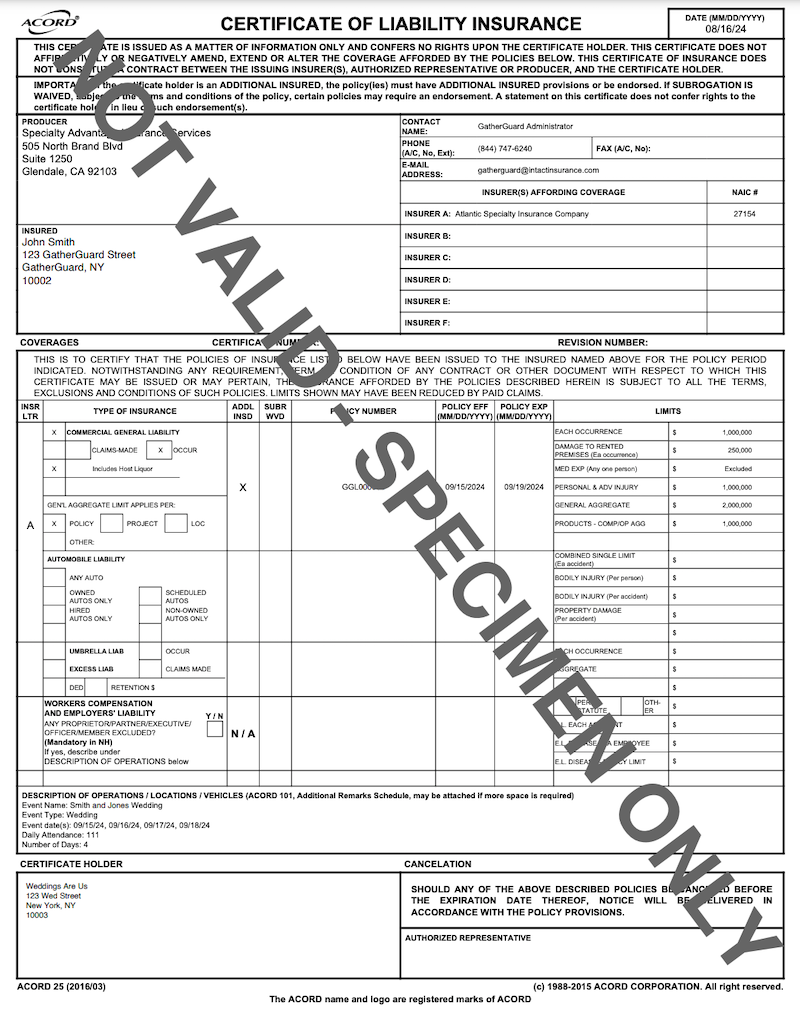

A certificate of insurance for one day event or COI is essentially a document that provides proof that coverages is in force per the parameters on the document.

See our comprehensive 2025 review of all the major U.S. event insurance companies:

What is a Certificate of Insurance For One Day Event?

The COI serves as proof of insurance. It details the types of coverage included in the policy, limits of liability, policy effective dates, and the name of the insured.

Producer

Producer is the insurer or the selling insurance agent/broker.

Insured

Insured is the person or entity that is covered by the insurance policy.

Insurer

Insurer(s) are the insurance companies backing the insurance policy.

Type of Insurance

This describes the types of activities and risks that the insurance policy is designed to cover. This can include:

- General liability

- Property damage

- Medical expenses

- Products and completed operations

- Liquor liability

- Deductibles

- and more!

Certificate Holder

This is where additional insureds are listed. Almost all venues now require that they be listed as an additional insured for event insurance policies, alongside other requirements.

Sample Certificates of Insurance

Many insurers provide sample certificates online. Two examples are below:

https://specialinsurance.com/sample-policy-and-certificates/

https://gatherguard.com/sample-policy-page/

How to Get a Certificate of Insurance For One Day Event

Purchasing event insurance is a straightforward process as many insurers provide online purchase options. Insurers that allow for online purchases include: Markel, GatherGuard, Allstate, SpecialInsurance.com, and State Farm.

Our Top Picks

Be sure to check your venue’s insurance requirements before securing a policy!

GatherGuard

Damage to rented premise limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Free quote feature available

SpecialInsurance.com

Damage to rented premise limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required